nassau county tax grievance status

When Will My Assessment Reduction Appear on My Tax Bills. If you file for yourself you may check your appeals status on-line at any time.

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

PROPERTY TAX GRIEVANCE AUTHORIZATION.

. Is located on our home page. Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs. Nassau County has paused property valuation updates due to continued instability of the real estate market.

Rules of Procedure PDF Information for Property Owners. Click to request a tax grievance authorization form now. However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties.

LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your. Our office handles the filing of tax grievances on behalf of all types of businesses and corporations throughout Nassau County.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing Period to May 2 2022 The Assessment Review Commission - ARC - acts on appeals of county property assessments. Well perform a property tax assessment and advocate for your interests in your quest to lower your property taxes. How to File an Appeal Using the AROW System.

Once this application has been submitted the Assessors Office will review the grievance. All Live ARC Community Grievance Workshops. This is done by filling out an application and submitting it with any supporting documentation to the Nassau County Assessors Office.

Ad Need Property Records For Properties In Nassau County. Between January 3 2022 and March 1 2022 you may appeal online. Any homeowners in Nassau County that misses the Property Tax Grievance deadline of March 1 2023 must wait until 2024.

Appeal your property taxes. Assessment Challenge Forms Instructions. 631 302-1940 Nassau County.

We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner. Ad Stand Up To The IRS. PAY MY BILL GET STARTED.

At the request of Nassau County Executive Bruce A. This website will show you how to file a property tax grievance for you home for FREE. Its free to sign up and bid on jobs.

Our record reductions in nassau county. How to Challenge Your Assessment. March 1 taxable status date all property is valued as of its condition on march 1.

Please Login to Continue The requested page cannot be accessed without logging in. March 2 Property tax rates in New York especially in Suffolk and Nassau counties are among the highest in the nation. For the last 18 years he has.

Ad Find Tax Grievance Nassau. For 2022 Have Now Been Completed. Find Information On Any Nassau County Property.

Nassau County residents have a right to file a property tax grievance if they feel that the assessed value of their property has been incorrectly determined. If you want to lower your Monthly Mortgage Bill and save money this is one of the easiest ways. Request Your Tax Grievance Form Today.

If you file for yourself you may check your appeals status on-line at any time. Nassau County Filing Deadline Extended to April 30 Previous Deadline for filing. FOR THE 20232024 Nassau COUNTY FILING.

Please enter your login information below. ARCs services for homeowners commercial taxpayers and tax. Nassau County residents should file a tax grievance each and every year.

For specific grievance questions about your property we suggest you contact ARC Customer service at 516-571-3214 or by e-mail at arcnassaucountynygov. If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance. Click to request a tax grievance authorization form now.

Nassau County residents should file a tax grievance each and every year. If youve chosen us to represent you feel free to email. At the request of Nassau County Executive Bruce A.

If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance. The tax grievance process is a lengthy and complicated one. All Live ARC Community Grievance Workshops.

For the 20232024 tax year a successful assessment reduction may be reflected in 3 possible ways. You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions. Nassau County Tax Lien Sale.

Given that multiple years tax challenges can be occurring at the same time Maidenbaum sends fully personalized summary letters explaining the status of each challenge. Under NYS law filing a Property Tax Grievance cannot raise your Property Taxes.

New To The Market In Rockville Centre 16 Willetts Ct Rockville Centre Rockville Outdoor Structures

Nassau County Legislature Provides An Extension For Filing A Tax Assessment Challenge Cullen And Dykman Llp

5 Myths Of The Nassau County Property Tax Grievance Process

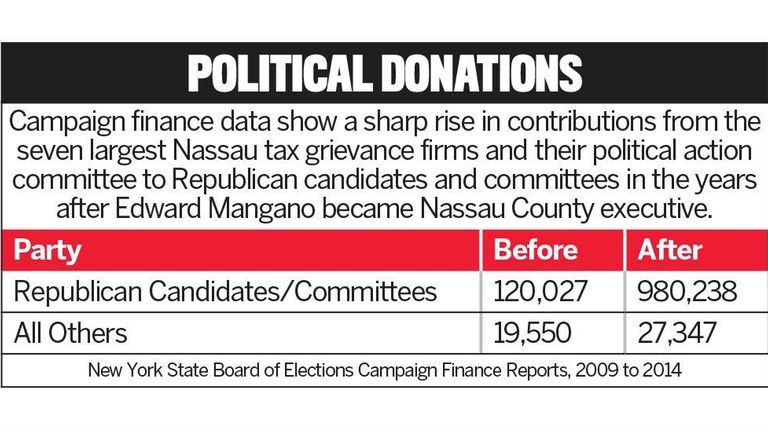

Nassau Tax Grievance Firms That Pushed For Changes Donated To Politicians Increased Fees By Millions Newsday

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

New To The Market In Rockville Centre Carol Gardens Co Op

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nassau County Property Tax Reduction Tax Grievance Long Island

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Rich Varon Nassau County Tax Grievance Home Facebook

Nassau County Property Tax Reduction Tax Grievance Long Island

Rich Varon Nassau County Tax Grievance Facebook

How To Appeal Your Nassau County Assessment Recorded March 13 2019 Youtube

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

Nassau Tax Grievance Firms That Pushed For Changes Donated To Politicians Increased Fees By Millions Newsday

Spring Is A Time For New Beginnings And Great Adventures Moving Into New Home New Beginnings Malverne